Turn Your Alcohol Budget Into Investment Gains

I used to have the mindset that retirement was something I didn't have to worry about until after I got my first 'real' job. You know, when you get that job that you consider an adult job that makes everything simple because you'd be making a ton and paying off student loans while saving for retirement - no problem!

Well I didn't land that adult job until I was in my upper 20's. I went to grad school twice, and was in that gray area where I had jobs but didn't think I had crossed that magic threshold somehow into adult job land. (Side note: Adult job land sounds like the name of a porn staffing company website).

So could I have been saving for retirement all along? Of course! I was living modestly, except for my entertainment budget. I would eat tuna and ramen noodles, then go drop $40 at happy hour once a week. Then, between eating out and my bar tab, I'd spend another $60 each weekend. That's $400 a month out the window!

Let's see what could have been different if I had invested that money instead. I'll try this two different ways. Since I got my first job with benefits in 2008 I could consider that my first adult job and calculate from there. But investing from 2008 to 2015 wouldn't be a typical period in the market since in hindsight that would be the perfect time to start investing right after the financial crash. So I'll calculate my "invest your bar tab" experiment with historical returns and with typical returns. (Here's a really nice Compound Interest Calculator).

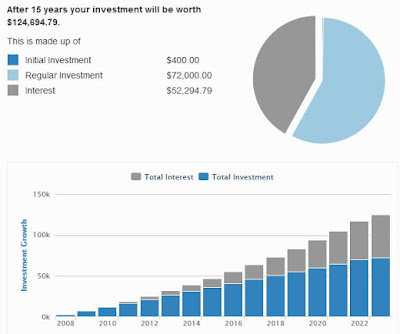

Initial investment: $400

Regular investment: $400/month

Compounded: Annually

Start date: 08-08-2008

Ok, starting with no principal chunk of change, just saving my bar money every month, let's see how things would shake out.

After 15 years with a 5% annual rate of return, my investment would be worth $107,192.98

With a 7% rate of return, it would be $126,249.13.

The actual historic Annualized Growth Rates for the S&P 500 (from the calculator on MeasuringWorth.com) for the period August 8, 2008 to December 2015 we're looking at about 6.85%, so my estimates are in the right ballpark. Of course, nobody knows what the returns will be in the next few years.

You can see that the bulk of the money is coming from the simple act of disciplined saving, but the interest does really start to add up after a while!

I chose to show 15 years because I think it's easier to imagine what you might be doing in 15 years rather than when you're about to retire. This same $400 a month carried out over a career of 42 working years would be a whopping $669,666.13 even with a pessimistic 5% return.

Well I didn't land that adult job until I was in my upper 20's. I went to grad school twice, and was in that gray area where I had jobs but didn't think I had crossed that magic threshold somehow into adult job land. (Side note: Adult job land sounds like the name of a porn staffing company website).

So could I have been saving for retirement all along? Of course! I was living modestly, except for my entertainment budget. I would eat tuna and ramen noodles, then go drop $40 at happy hour once a week. Then, between eating out and my bar tab, I'd spend another $60 each weekend. That's $400 a month out the window!

Let's see what could have been different if I had invested that money instead. I'll try this two different ways. Since I got my first job with benefits in 2008 I could consider that my first adult job and calculate from there. But investing from 2008 to 2015 wouldn't be a typical period in the market since in hindsight that would be the perfect time to start investing right after the financial crash. So I'll calculate my "invest your bar tab" experiment with historical returns and with typical returns. (Here's a really nice Compound Interest Calculator).

Initial investment: $400

Regular investment: $400/month

Compounded: Annually

Start date: 08-08-2008

Ok, starting with no principal chunk of change, just saving my bar money every month, let's see how things would shake out.

After 15 years with a 5% annual rate of return, my investment would be worth $107,192.98

With a 7% rate of return, it would be $126,249.13.

The actual historic Annualized Growth Rates for the S&P 500 (from the calculator on MeasuringWorth.com) for the period August 8, 2008 to December 2015 we're looking at about 6.85%, so my estimates are in the right ballpark. Of course, nobody knows what the returns will be in the next few years.

You can see that the bulk of the money is coming from the simple act of disciplined saving, but the interest does really start to add up after a while!

|

| Putting away $400 a month with 6.85% annual return after 15 years |